Highest EBITDA in Q3-24. Biggest PAT expected in FY24. Strong order book for Q4-24. Generating free cash. At reasonable valuations in terms of free cash flow yield. Cushion of cash in balance sheet

1. Manufacturing of Steel Pipes and Tubes

jindal.com/msl-seamless-pipe.html | NSE : MAHSEAMLES

- Market share of 55% in seamless pipes segment.

- Market share of 18% in the API certified, high frequency ERW pipes segment.

2. FY17-23: Years of low or no growth followed by a pickup in FY22

FY17-23 CAGR:

- Revenue = 24%

- PAT = 37%

- Free cash flow (FCF) = 42% i.e. PAT converted into free cash for MAHSEAMLES

3. FY23: PAT up 11% and Revenue up 36% YoY

4. H1-24: PAT up 52% & Revenue is flat

5. Strong Q3-24: PAT up 73% & Revenue up 7% YoY

PAT up 10% & Revenue down 7% QoQ

6. 9M-24: PAT up 59% & Revenue up 2% YoY

7. Business metrics: Solid return ratios

8. Outlook: Revenue growth of 33% between FY24-FY26

i. FY24: 5% volume growth

ii. Revenue growth of 33% between FY24-FY26

Planned capex expected to increase revenue by Rs 1,900 cr by FY26 which around 33% higher than the revenue expected for FY24.

iii. Strong revenue visibility: Strong Order book for Q4-24

short-duration order books of around 3 to 4 months, which is replenished on a daily basis.

9. PAT growth of 59% and revenue growth of 2% in 9M-24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to MAHSEAMLES

- Coverage of MAHSEAMLES was initiated after Q2-24 results. The investment thesis has not changed after a strong Q3-24. The delivery of a strong 9M-24 has increased confidence in the management to deliver a stronger FY24 compared to FY23

In Q3 FY ’24, like we have done in earlier quarters, we have improved upon our margins and have achieved highest EBITDA

- With 5% growth in FY24, the future growth is dependent solely on timely execution of planned Capex. Time and cost overruns in the execution of the capex could be a reason to exit the stock. One needs to keep a close watch on the capex execution every quarter.

- Industry tailwinds are strong

Capital goods and infrastructure in general and oil and gas specifically continue to witness strong demand in short to medium term. This directly impacts the seamless pipes market. Our seamless pipes market remains buoyant, driven by capital expenditure and spending in oil and gas sector as we have seen our order book being replenished and maintained at good level.

11. Or, join the ride

If I am looking to enter MAHSEAMLES then

- MAHSEAMLES has delivered PAT growth of 59% and revenue growth of 2% in 9M-24 at a PE of 13 which makes valuations reasonable.

- MAHSEAMLES delivered Rs 543 cr of free cash flow against a market cap of Rs 13,140 cr. As of H1-24 end it is available on a free cash flow yield of 4.1% (not annualized) which makes the valuations quite attractive.

- Desire of the promoter to increase their holdings to 75% inspiring confidence in MAHSEAMLES

The current stake is 68%. Promoter and Promoter Group have earlier committed that they will gradually increase their stake to 75%. That is still an open option.

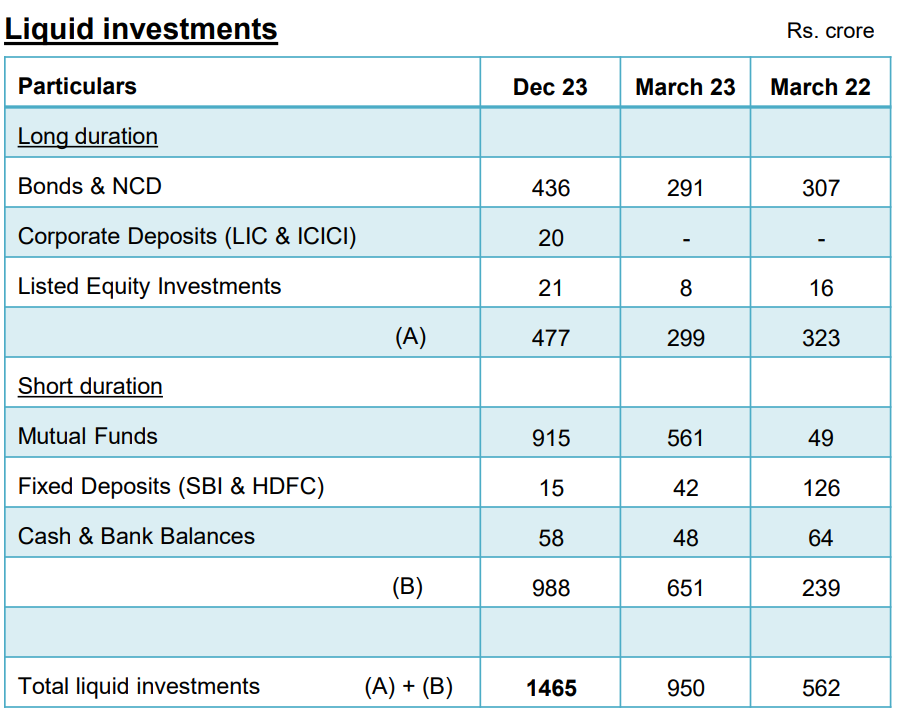

- Rs 1,465 cr of liquid investments on books as of end of Q3-24 on a market cap of Rs 13,140 cr implies that about 11% of market cap is in liquid investments which provides a margin of safety in the valuations.

We are a 100% debt-free company. We currently have liquid investments of almost INR1,500 crores. I take this opportunity to communicate yet again that our treasury will only be utilized for core operations and shareholder benefit. They shall not be utilized for any other activity